Economic order quantity

| Corporate finance |

|---|

| Working capital |

|

Cash conversion cycle |

| Capital budgeting |

| Sections |

| Societal components |

Economic order quantity is the level of inventory that minimizes total inventory holding costs and ordering costs. It is one of the oldest classical production scheduling models. The framework used to determine this order quantity is also known as Wilson EOQ Model or Wilson Formula. The model was developed by Ford W. Harris in 1913, but R. H. Wilson, a consultant who applied it extensively, is given credit for his in-depth analysis.[1]

Contents |

Overview

EOQ applies only when demand for a product is constant over the year and each new order is delivered in full when inventory reaches zero. There is a fixed cost for each order placed, regardless of the number of units ordered. There is also a cost for each unit held in storage, sometimes expressed as a percentage of the purchase cost of the item.

We want to determine the optimal number of units to order so that we minimize the total cost associated with the purchase, delivery and storage of the product.

The required parameters to the solution are the total demand for the year, the purchase cost for each item, the fixed cost to place the order and the storage cost for each item per year. Note that the number of times an order is placed will also affect the total cost, though this number can be determined from the other parameters.

Underlying assumptions

- The ordering cost is constant.

- The rate of demand is known, and spread evenly throughout the year.

- The lead time is fixed.

- The purchase price of the item is constant i.e. no discount is available

- The replenishment is made instantaneously, the whole batch is delivered at once.

- Only one product is involved.

EOQ is the quantity to order, so that ordering cost + carrying cost finds its minimum. (A common misunderstanding is that the formula tries to find when these are equal.)

Variables

= order quantity

= order quantity = optimal order quantity

= optimal order quantity = annual demand quantity

= annual demand quantity = fixed cost per order (not per unit, typically cost of ordering and shipping and handling. This is not the cost of goods)

= fixed cost per order (not per unit, typically cost of ordering and shipping and handling. This is not the cost of goods) = annual holding cost per unit (also known as carrying cost or storage cost) (warehouse space, refrigeration, insurance, etc. usually not related to the unit cost)

= annual holding cost per unit (also known as carrying cost or storage cost) (warehouse space, refrigeration, insurance, etc. usually not related to the unit cost)

The Total Cost function

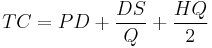

The single-item EOQ formula finds the minimum point of the following cost function:

Total Cost = purchase cost + ordering cost + holding cost

- Purchase cost: This is the variable cost of goods: purchase unit price × annual demand quantity. This is P×D

- Ordering cost: This is the cost of placing orders: each order has a fixed cost S, and we need to order D/Q times per year. This is S × D/Q

- Holding cost: the average quantity in stock (between fully replenished and empty) is Q/2, so this cost is H × Q/2

.

.

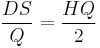

To determine the minimum point of the total cost curve, set the ordering cost equal to the holding cost:

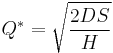

Solving for Q gives Q* (the optimal order quantity):

Therefore:  .

.

Q* is independent of P; it is a function of only S, D, H.

Extensions

Several extensions can be made to the EOQ model, including backordering costs and multiple items. Additionally, the economic order interval can be determined from the EOQ and the economic production quantity model (which determines the optimal production quantity) can be determined in a similar fashion.

A version of the model, the Baumol-Tobin model, has also been used to determine the money demand function, where a person's holdings of money balances can be seen in a way parallel to a firm's holdings of inventory.[2]

Example

- Suppose annual requirement quantity (Q) = 10000 units

- Cost per order (CO) = $2

- Cost per unit (CU)= $8

- Carrying cost %age (%age of CU) = 0.02

- Carrying cost Per unit = $0.16

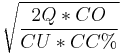

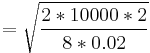

Economic order quantity =

Economic order quantity = 500 units

Number of order per year (based on EOQ)

Number of order per year (based on EOQ) =

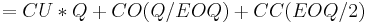

Total cost

Total cost

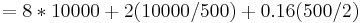

Total cost

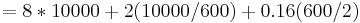

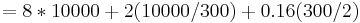

If we check the total cost for any order quantity other than 500(=EOQ), we will see that the cost is higher. For instance, supposing 600 units per order, then

Total cost

Total cost

Similarly, if we choose 300 for the order quantity then

Total cost

Total cost

This illustrates that the Economic Order Quantity is always in the best interests of the entity.

See also

- Demand is random: Classical Newsvendor model

- Demand varies over time: Dynamic lot size model

- Several products produced on the same machine: Economic Lot Scheduling Problem

- Reorder point

References

- ^ Hax, AC and Candea, D. (1984), Production and Operations Management, Prentice-Hall, Englewood Cliffs, NJ, pp. 135, http://catalogue.nla.gov.au/Record/772207

- ^ Andrew Caplin and John Leahy, "Economic Theory and the World of Practice: A Celebration of the (S,s) Model", Journal of Economic Perspectives, Winter 2010, V 24, N 1

See also:

- Harris, Ford W. "How Many Parts To Make At Once" Factory, The Magazine of Management, 10(2), 135-136, 152 (1913). Online

- Harris, Ford W. Operations Cost (Factory Management Series), Chicago: Shaw (1915).

- Wilson, R. H. "A Scientific Routine for Stock Control" Harvard Business Review, 13, 116-128 (1934).

vipov